Figuring return on investment calculator

Therefore the calculator gives the user the option for two rates of return one for the pre-retirement investment and one for the after retirement investment. The investment rate change happens on the date of the last contribution.

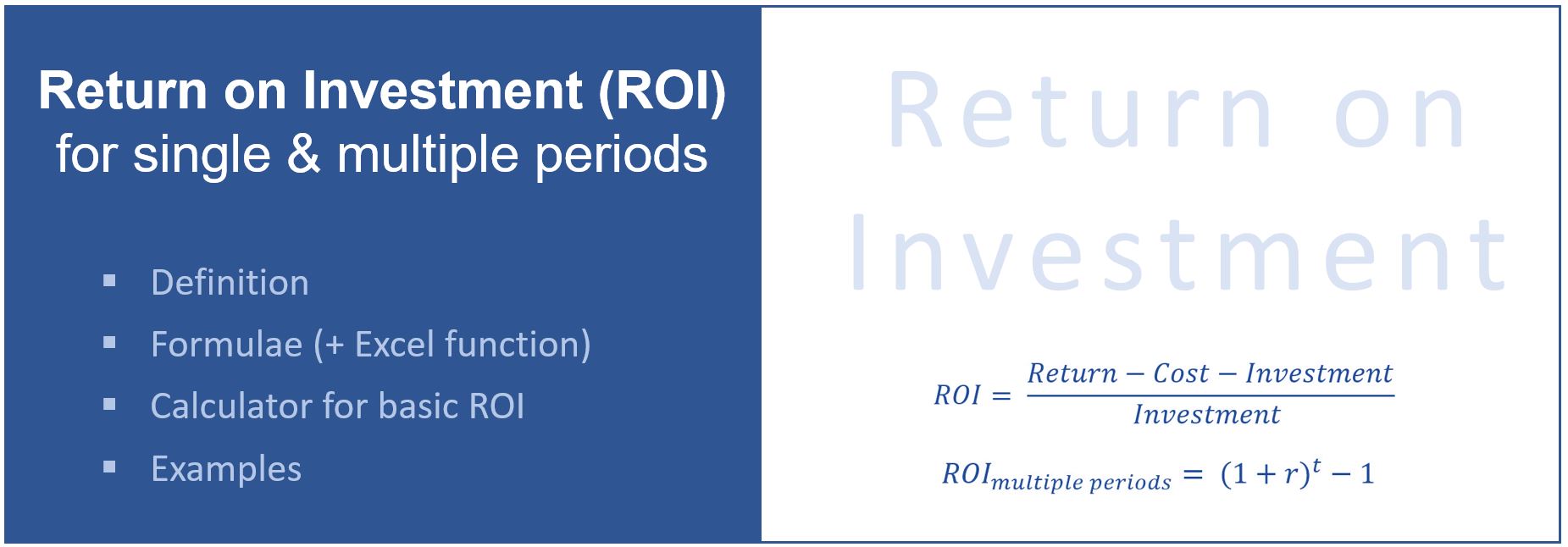

Return On Investment Single Multi Period Roi Formulae Examples Calculator Project Management Info

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

.jpg)

. For example if the individual owns a car that is relatively reliable even if it is older they need to weigh the costs of purchasing a new one. DENOTES A REQUIRED FIELD. Our student loan calculator tool helps you understand what your monthly student loan payments will look like and how your loans will amortize be paid off over time.

Real estate is property consisting of land and the buildings on it along with its natural resources such as crops minerals or water. To calculate the percentage ROI for a cash purchase take. The calculator can estimate several annuity metrics including.

A Special Investment Vehicle. Interest Calculator Simple Compound Interest. Starting value used as the basis for payments Estimated annual income.

1 The assumed rate of return 4 pa. In fact CAGR suggest that the growth rate is constant. The general rule of thumb is that you should pay estimated taxes if its likely that youll owe the IRS 1000 or more when you file your tax return.

Experian Q2 2018 State of the Automotive Finance Market Keeping an Existing Automobile Instead of Purchasing a New One. This calculator tells you if youre getting a good deal when you buy their stock. Compares simple monthly interest income to long term compound growth for surprising results.

AMT rates are 26 or 28. Section 179 deduction dollar limits. For individual taxpayers in Q4 2022 the rate for overpayments and underpayments will be 6 per year compounded daily up from 5 in Q3 2022.

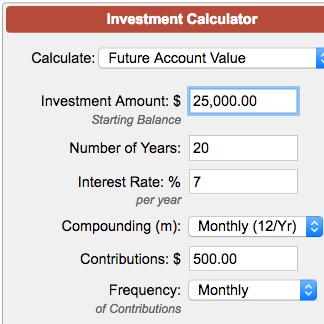

To calculate the future value of a monthly investment enter the beginning balance the monthly dollar amount you plan to deposit the interest rate you expect to earn and the number of years you expect to continue making monthly deposits then click the Calculate. What is Investment Definition. This calculator will help you to determine the future value of a monthly investment at various compounding intervals.

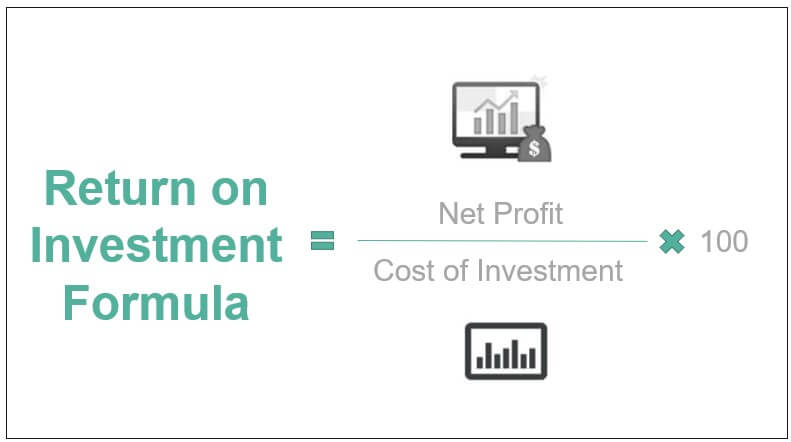

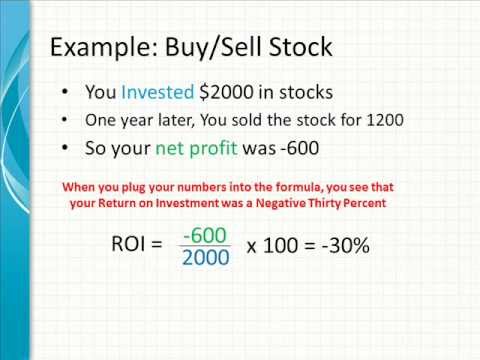

Tax Deferred Investment Growth Calculator. Return on investment ROI measures how much money or profit is made on an investment as a percentage of the cost of that investment. It is because the CAGR computes the.

How will my future value and investment return differ between taxable and tax deferred investing. Exchange-traded funds ETFs have become an increasingly popular investment instrument over the past few decades. A tax return calculator takes all this into account to show you whether you can expect a refund or not and give you an estimate of how much to expect.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. An investment is essentially an asset that is created with the intention of allowing money to grow. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong.

ETFs are similar to mutual funds in that they utilize the combined investment capital of a number of individual investors. The Math Behind Our Mortgage Calculator. Compares simple monthly interest income to long term compound growth for surprising results.

The alternative minimum tax AMT uses certain calculations to ensure certain people pay a minimum amount of income tax. The manual computation can be slightly labor-intensive since SIPs typically involve a monthly payment. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2700000Also the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2022.

And 8 pa shown in the illustrative example are not guaranteed and they are not the upper or lower limits of what you might get back as the value of your policy depends on a number of factors including future investment performance The amount shown is for 30-year-old healthy male 15 years premium payment term 30 years. P Principal Amount initial loan balance i Interest Rate. Immovable property of this nature.

Interest Calculator Simple Compound Interest. If your spouse is more than ten years younger than you please review IRS Publication 590-B to calculate your required minimum distribution. In terms of law real is in relation to land property and is different from personal property while estate means.

For those who want to know exactly how our calculator works we use the following formula for our mortgage calculations. Tax Deductions and Tax Credits Explained Remember that a tax deduction reduces your taxable income cutting your tax bill indirectly by reducing the income thats subject to a marginal tax rate. M Monthly Payment.

An interest vested in this also an item of real property more generally buildings or housing in general. How will my future value and investment return differ between taxable and tax deferred investing. As CAGR reflects a smoothed growth over the investment period it doesnt reflect the volatility of the investment value.

Exchange-Traded Funds ETFs This is an important section of investing for novices. With CAGR it is impossible to calculate the profitability of an investment with inflows and outflows during the investment period. Final ending value at the end of your designated payout period Annual net return.

First we calculate the monthly payment for each of your respective loans individually taking into account the loan amount interest rate loan term and prepayment. N Number of Monthly Payments for 30-Year Mortgage 30 12 360 etc How to Use Our Mortgage. A Systematic Investment Plan SIP calculator is an online tool that calculates the return on your SIP investment based on an estimated rate of return and the future value of your investment after a certain number of years.

How to Use These Investment Calculators Rule 1 investing is based around some very specific calculations that help paint a picture for how a business is being run if a stock is selling at the right price and how long it should take you to make your money back. Tax Deferred Investment Growth Calculator. The wealth created can be used for a variety of objectives such as meeting shortages in income saving up for retirement or fulfilling certain specific obligations such as repayment of loans payment of tuition fees or purchase of other assets.

For example it can estimate the average rate of return you could expect from a variable or equity-indexed annuity. More conservative investments usually have a lower rate of return yield or interest rate. The first factor to consider is the motivation behind the purchase.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401k account this year.

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Return On Investment Definition Formula Roi Calculation

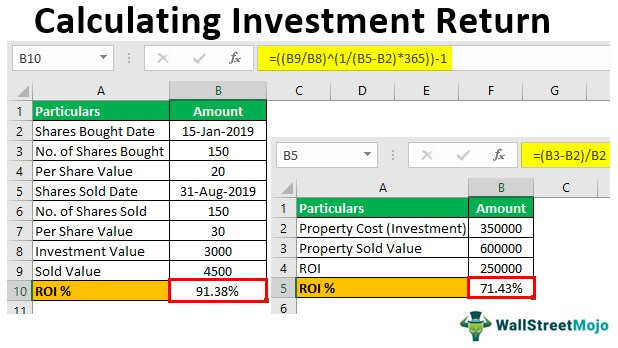

Calculating Investment Return In Excel Step By Step Examples

Return On Investment Analysis For An Investor Plan Projections

5 Easy Ways To Measure The Roi Of Training

How To Calculate Return On Investment Roi For Cannabis Retail Data Tools Cannabis Big Data

Calculating Return On Investment Roi In Excel

Return On Investment Roi Formula And Calculator Excel Template

Return On Investment Roi Definition Equation How To Calculate It

Calculating Return On Investment Roi In Excel

Return On Investment Roi Definition Equation How To Calculate It

Roi Calculator Best Sale 58 Off Www Wtashows Com

Investment Calculator

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

Roi Calculator Best Sale 58 Off Www Wtashows Com

How To Calculate Roi Youtube

Roi Calculator Formula The Online Advertising Guide Ad Calculators